A stock swap can be a great strategy to use if you have employee stock options you’d like to exercise and hold. It allows you to use the fair market value (FMV) of company stock you already own to pay for the exercise cost of newly acquired employee stock option shares.

Shares you own that can be used for a stock swap can include those you’ve purchased on the open market, shares acquired from vested restricted stock units, shares you own from an exercise and hold of previous employee stock options, and/or shares acquired from and employee stock purchase plan.

But be aware that each type of share you use in a swap can generate different tax implications. It’s a good idea to work with a professional to ensure you choose a specific strategy that makes sense in the context of your overall financial situation.

The First Step to a Stock Swap: Check Your Plan Document

If you are considering a stock swap, the first step may be to check your plan document. While many plans allow for a stock swap, you’ll want to be sure yours is one of them.

If your plan document allows, a stock swap may make sense if you don’t have the cash available to do a cash exercise of stock options. It may also make sense if you are not seeking to maximize the number of shares you own.

In fact, a stock swap will often result in you having less value in company stock than you did prior to the exercise.

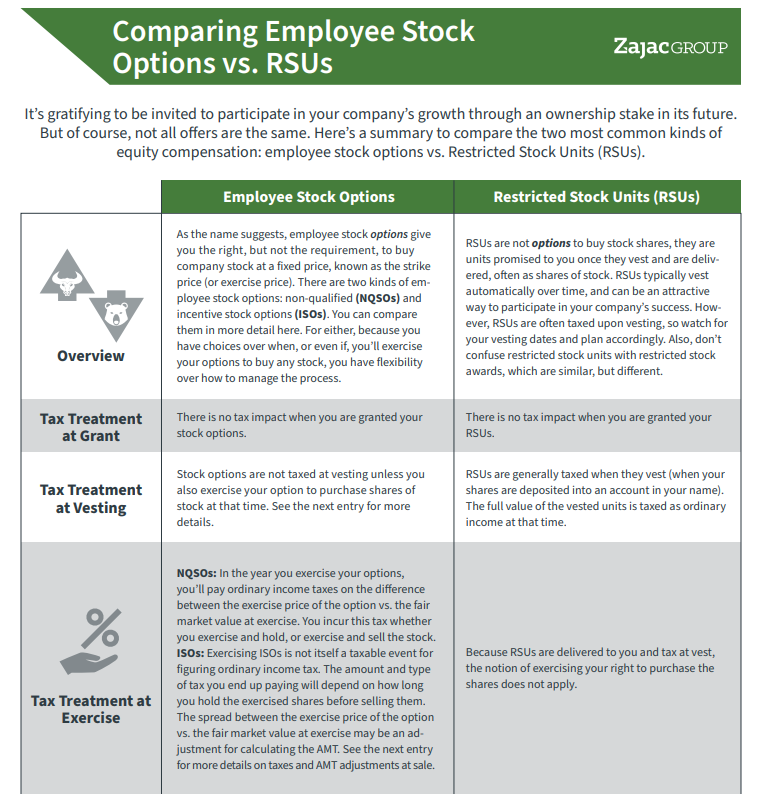

COMPARISON GUIDE

Not All Stock Offers are the Same! Here's a helpful comparison between two of the most common employee stock options.

How a Stock Swap Works in the Real World

Let’s assume you own the following shares of company stock that you previously purchased on the open market. We will define these as long-only shares:

| Long-Only | Current Share Price | Cost Basis / Share | Total Value |

| 10,000 | $50.00 | $20.00 | $500,000 |

Let’s also assume that you want to exercise the following employee stock options or ESOs. For the sake of this immediate example, we will not distinguish between non-qualified stock options and incentive stock options (but we will cover each later in the article).

| ESO | Exercise Price | Exercise Cost | Current Share Price | Total Value |

| 5,000 | $10.00 | $50,000 | $50.00 | $250,000 |

The exercise cost of the ESO is $50,000. This cost can be paid for in a number of ways. You could do a cash exercise, a cashless exercise, or a stock swap.

If you are doing a stock swap, you pay the exercise cost of $50,000 by swapping the fair market value (FMV) of long-only shares equal to the exercise cost of the ESO.

If you held 10,000 long-only shares and wanted to exercise 5,000 ESOs, you will use fewer than 5,000 long-only shares to exercise and hold 5,000 employee stock options. This is because you are using the current share price of long-only stock to buy ESO shares at the exercise price, which is lower than the current share price.

How many shares you need to swap is based on the spread between the current share price of the stock and the exercise price of the options:

Number of Shares Swapped = “Exercise Cost” / “Current Share Price”

=$50,000 / $50

= 1,000

in this hypothetical example that accounts for the exercise price of the stock option only (and not the potential tax due), you can swap 1,000 of your long-only shares to exercise the 5,000 employee stock options.

A swap is simply an additional way to exercise your options. More specifically, a stock swap may limit how many shares of stock you own and/or manage tax.

Stock Swaps and the Impact on Concentrated Equity

The end result of a stock swap is often that you control fewer shares post-swap then you did pre-swap.

Prior to the stock swap, you had owned 10,000 long-only shares and the option to purchase 5,000 shares from the ESO. You “controlled” 15,000 shares.

After the stock swap, you have 9,000 long-only shares and 5,000 newly acquired shares from the exercise and hold of the ESO. You now “control” 14,000.

Because of this reduction in total shares controlled, a stock swap is one way to limit or decrease your concentrated equity position. It may then make sense for someone who isn’t bullish on the stock or someone who wants to diversify their assets.

Comparing a Stock Swap to Other Exercise Methods

To evaluate whether a stock swap is a good idea or a bad idea, it makes sense to compare it to other exercise strategies. Two common strategies are a cash exercise and a cashless exercise.

A cash exercise may be a preferable strategy to stock swap if you are bullish on your company stock and want to retain as many shares as possible. With a cash exercise, you retain more shares post-exercise than you do with a stock swap.

In our example, you will pay $50,000 to exercise and hold the ESO. Since you paid cash, you will retain the 10,000 long-only shares you own and pick up an additional 5,000 shares from the ESO, for a total of 15,000 shares. This is 1,000 shares more than the swap stock in our example.

The second option is a cashless exercise. If you are not bullish on your company stock or want to diversify your concentrated position, a cashless exercise may be a better strategy for you.

In a cashless exercise, you use shares acquired via the exercise itself to cover the cost of the exercise. Continuing with numbers from our examples above and only addressing the purchase of the stock option (not income tax), with a cashless exercise, you’d exercise and immediately sell 1,000 ESO shares.

Number of Shares to Cover = “Cost of Exercise” / “Current Share Price”

= $50,000 / $50

= 1,000

Since you sold 1,000 of your ESO to cover the cost, you retain the remaining 4,000. Post cashless exercise, you own 10,000 previously owned shares and 4,000 shares from the exercise and hold, for a total of 14,000 shares

Both the stock swap scenario and the cashless exercise scenario, you retain 14,000 shares. The post-exercise share control is identical.

However, by digging further, you will see that the shares come from different sources.

| Long-Only | ESO Shares | Total Shares | Cash Required | |

| Cash Exercise | 10,000 | 5,000 | 15,000 | $50,000 |

| Stock Swap | 9,000 | 5,000 | 14,000 | $0 |

| Cashless Exercise | 10,000 | 4,000 | 14,000 | $0 |

This difference is important as we evaluate the tax impact if the employee stock options are non-qualified or incentive stock options.

Stock Swap and the Tax Impact for Non-Qualified Stock Options

When you use long-only stock to exercise non-qualified stock options (NQSO) via a stock swap, the swapped shares retain their original cost basis and acquisition date through the exercise. Swapping shares is generally a non-taxable event.

However, the exercise itself is a taxable event subject to normal NQSO tax rules. This means that the bargain element of your exercised non-qualified stock options is subject to ordinary income, Medicare, and Social Security tax, if applicable.

Let’s assume that you have the following NQSOs:

| NQSO | Exercise Price | Exercise Cost | Current Share Price | Total Value |

| 5,000 | $10.00 | $50,000 | $50.00 | $250,000 |

When you exercise your 5,000 non-qualified stock options, you will pay income tax on the bargain element of $200,000. You pay income tax regardless of how you pay for the exercise cost of your NQSO.

Assuming you do a stock swap of 1,000 long-only shares that have a cost basis of $20 per share, the cost basis of your retained shares will look like this:

| Long-Only | NQSO Shares | Total | |

| Shares | 9,000 | 5,000 | 14,000 |

| Cost Basis | 9,000 at $20.00/share | 1,000 at $20/share

4,000 at $50/share |

14,000 |

| Total Cost Basis | $180,000 | $220,000 | $400,000 |

After the swap, you retain 9,000 long-only shares. The cost basis of these 9,000 shares remains unchanged at $20/share. You have also acquired 5,000 newly owned shares from the exercise of the NQSO.

Of these shares, 1,000 will have a carryover basis (and holding period for calculating long term capital gains) of $20/share. The remaining 4,000 shares will have a cost basis of $50/share, which is the FMV at the time of exercise.

Stock Swaps and the Tax Impact for Incentive Stock Options

You can use long-only stock to exercise incentive stock options, too. Like NQSOs, the tax rules regarding an exercise of incentive stock options, or ISOs, are the same whether you exercise via a stock swap or via another method.

This means that when you exercise and hold ISOs, the bargain element will be a tax preference item for calculating the alternative minimum tax, assuming you exercise and hold the shares past the calendar year-end. It also means that exercised ISOs equal to the number of shares swapped will retain the cost basis of the original shares. However, the newly acquired shares via the exercise will likely have a basis equal to zero.

Continuing our example from above, but now assuming that you have ISOs, we can illustrate a stock swap for ISOs:

| ISO | Exercise Price | Exercise Cost | Current Share Price | Total Value |

| 5,000 | $10.00 | $50,000 | $50.00 | $250,000 |

If you exercise and hold ISOs in an attempt to achieve a qualifying disposition (hold the shares past year-end), you do not claim ordinary income in the year of exercise. Instead, the bargain element is a tax preference item for calculating the AMT.

Since the bargain element not claimed as ordinary income, it has no adjustment to that cost basis of the new shares. If we assume you do a stock swap of 1,000 long-only shares that have a cost basis of $20 per share, the cost basis of your retained ISO shares will look like this:

| Long-Only | ISO Shares | Total | |

| Total Shares | 9,000 | 5,000 | 14,000 |

| Regular Cost Basis | 9,000 at $20.00/share | 1,000 at $20/share

4,000 at $0/share |

14,000 |

| AMT Cost Basis | 5,000 at $50/share |

After the swap, you retain 9,000 long-only shares with a regular cost basis of $20/share. You also have 1,000 shares from the exercise of the ISO with a carry-over cost basis of $20 per share. These two are the same as what we saw in the example with NQSOs.

The remaining 4,000 shares here, however, have a cost basis of $0/share (which is different than in the NQSO example above).

It’s equally important to track the AMT basis. While the cost basis for calculating the regular tax is $0/share, the cost basis for calculating AMT is $50/share. This is because the entire bargain element is taxed when calculating the AMT.

Having two basis figures when exercising and holding ISOs is commonly known as a dual basis.

Stock Swaps for Other Share Types

The above illustrations cover what a stock swap may look like if you own long-only shares and use those shares for the swap. Typically, long-only shares are shares you purchased on the open market, acquired when your restricted stock units vested or obtained when you exercised non-qualified stock options.

The shares types above typically have a single cost basis that makes them look similar in terms of how they can be used to exercise your employee stock options and what the tax implications may be.

You can also use shares acquired from an employee stock purchase plan or from an exercise and hold of other incentive stock options grants to do a stock swap. However, the rules and taxability of which may become significantly more complicated.

This is because these shares often have different tax rules subject to holding period requirements. These requirements and subsequent tax rules can make using shares received through an ESPP and ISOs in a stock swap more complicated than other methods.

Stock Swap as an Exercise Strategy

A stock swap can be a useful strategy that allows you to do a tax-free swap of shares you own for employee stock option shares. That being said, remember that while the swap is tax-free, the exercise itself is not.

When doing a stock swap, you use the FMV of the existing shares to acquire ESO shares at their exercise cost. This typically results in you using some existing shares to acquire more — although your total control of company shares actually goes down.

If you want to limit your position in a stock, a stock swap may be a zero-cash-required way to exercise your ESOs and reduce your overall exposure to a single stock. If you want to maximize your concentrated position, you may want to pass on a stock swap and use cash to exercise your ESOs.

Either way, the experience, objectivity, and accountability a professional can offer may be a worthwhile cost if you need help determining whether a stock swap is right for you.

Thanks! Well presented info.

Do you know, please, what IRS code/instruction that regulate Stock Swap as an Exercise of NSO?