If you work for a private company and receive restricted stock units as part of your compensation package, that equity compensation may have a double-trigger provision.

While not all restricted stock units, or RSUs, come with this feature, it’s an important element to understand.

What Are Double-Trigger RSUs?

Double-trigger restricted stock units are those that aren’t taxable until two specific events occur. This differs from most RSUs provided by public companies, where shares are taxable immediately upon vesting.

Double-trigger RSUs are usually taxed after the following events occur:

- The RSU grants vest, often based on a specific time-based vesting schedule, and

- The company experiences a liquidity-based event, such as an acquisition or an IPO.

The downside of this is that you can’t take ownership of double-trigger RSUs until both events happen. However, the double-trigger feature might ultimately be in your best interest because this structure prevents a taxable event from occurring before you have the ability to sell shares of stock to cover the tax liability.

To understand more about how double-trigger restricted stock units and the events that set taxation in motion work, we should first look at how RSUs are usually granted and taxed at public companies.

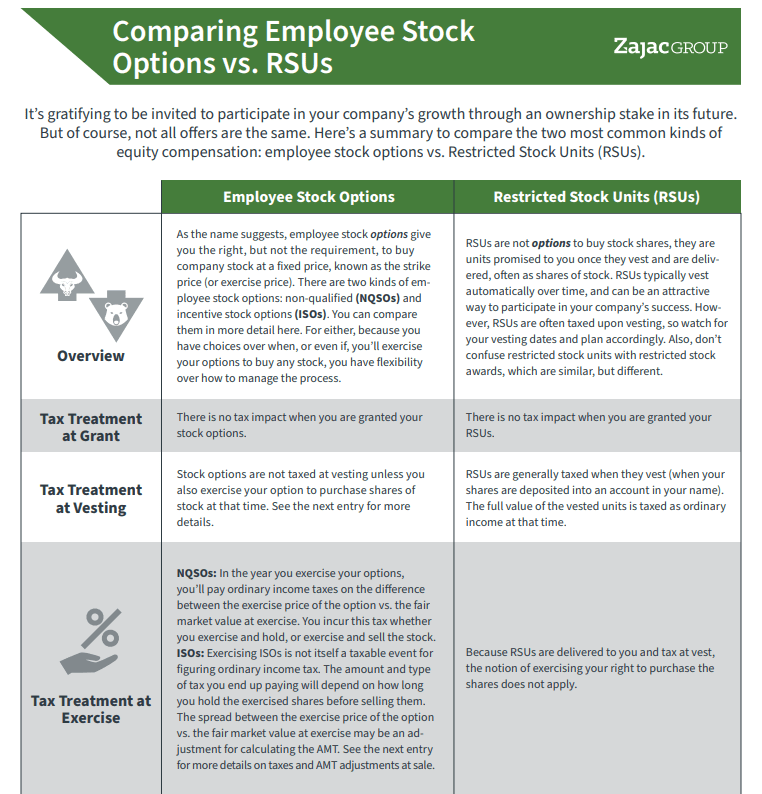

COMPARISON GUIDE

Not All Stock Offers are the Same! Here's a helpful comparison between two of the most common employee stock options.

The Usual Restricted Stock Unit Process for a Public Company

Generally speaking, RSUs are granted with a single time-based vesting schedule that states some or all of the RSUs will vest and become yours on set dates. Vesting schedules are commonly graded or based on what’s called a cliff.

A graded schedule means that some shares vest each period over many months, quarters, or years. A cliff vesting schedule means that all your RSUs will vest at one point in time.

Vesting dates often dictate when:

- A taxable event occurs.

- Income tax is withheld, often via a share withholding.

- You take ownership of the net number of shares (assuming you have share-settled RSUs)

You should always check your grant agreement for the specific vesting schedule and other details applicable to your equity compensation package, as they do differ in structure. But as an example, an RSU grant might look something like this:

- RSUs Granted: 10,000

- Vesting Schedule: 25% of your units on the first vest date, then 1/48th of the original grant vests monthly thereafter

- First Vest Date: 06/01/2021

- Fair Market Value on First Vest Date: $50

Using the details from this example, we can see what this RSU grant would look like through vesting, how it would be taxed, and what would be withheld to meet some or all of that tax liability:

- Shares Vested on 06/01/2021: 2,500

- Taxable Income (Based on FMV of 2,500 Shares at $50 Each): $125,000

- Tax Automatically Withheld at Vest (22%) = $27,500

Your company will often withhold at the 22% statutory tax rate when your RSUs vest. If your income is greater than $1,000,000, the statutory rate is 37%. Either way, the amount withheld may or may not meet your actual tax obligation, depending on your marginal tax bracket.

Again, check your plan document and consult with your own tax advisor to confirm the specifics of your situation.

Once vested, the shares remaining after-tax withholding are deposited into a brokerage account. In this example, 550 shares will be withheld (22% Federal tax rate = $27,500 / FMV per share = $50), and 1,950 shares will be deposited into your account (2,500 vested units – 550 withheld to cover taxes).

Why the Standard Way of Granting RSUs May Not Work for Employees of Private Companies

The process detailed above is widespread for employees of public companies that have a liquid market and the ability to sell shares to cover the due tax.

The shares vest, tax is due, that tax is withheld in units, and the remaining shares are deposited into a brokerage account. From there, assuming you are not in a blackout or lockup period, you can keep or sell the shares that you now own.

This process might not work so well for employees at private companies because shares of vested RSUs may not be liquid in the same way they would be for a publicly-traded company.

Using the example above, let’s assume that your private company shares vest at $50 per share. The good news is that you now own 2,500 shares worth $125,000 of stock of your private company. The bad news is that you may not be able to sell these shares right away.

In fact, you may never be able to sell your shares if the company doesn’t have a liquidity event. But receiving vested RSUs, even when you can’t sell them, is still a taxable event.

Without the provision for a double-trigger, you’d still owe $27,500 to meet the statutory withholding when the taxable event (RSUs vesting) occurs. If your marginal tax bracket is higher than 22%, you may owe even more at tax time. You’d owe all of this tax on shares of an illiquid stock, potentially creating a major cash crunch.

The double-trigger feature of private company RSUs can help mitigate cash flow issues associated with a taxable event of an illiquid stock. Because a vesting event and another event like an IPO must happen, you won’t get stuck with a massive tax bill and shares you can’t sell.

However, there are additional considerations that you might want to explore if you have double-trigger RSUs.

Your Shares Might Not Be Delivered Immediately After the Second Event Occurs

With time-vested shares of a public company, the shares are commonly delivered to your account on the day (or very near to) the units vest. With double-trigger RSUs, the units may not settle on the same day the second event happens. For various reasons, it might take days or even weeks for your shares to settle.

You Might Be in a Higher Tax Bracket Later

With double trigger RSUs, the time-vested event may occur over several tax years, but the liquidity event will likely occur in a single tax year. This opens you up to the risk of having a significantly higher income in that one year where everything becomes taxable.

This means you could owe far more in taxes all at once if you got unlucky with your timing (and earned significantly more in the same year your RSUs triggered taxes). It also means you lose the ability to spread the total tax liability through several years, and instead must pay all in one.

We can compare a single graded vesting schedule against the same schedule with a double-trigger event to see the impact. Here’s what a standard RSU vesting schedule might look like:

| Taxable Year | Vested Shares | FMV at Vest | Annual Taxable Income |

| 1 | 2,500 | $50.00 | $125,000 |

| 2 | 2,500 | $50.00 | $125,000 |

| 3 | 2,500 | $50.00 | $125,000 |

| 4 | 2,500 | $50.00 | $125,000 |

For double-trigger RSUs, we know they need to vest and a liquidity event needs to happen. If we assume a liquidity event occurs at the end of year 4, which causes a taxable event with the granted shares, the tax impact looks quite different:

| Taxable Year | Vested Shares | FMV at Vest + Liquidity | Annual Taxable Income |

| 1 | 2,500 | $0 | |

| 2 | 2,500 | $0 | |

| 3 | 2,500 | $0 | |

| 4 | 2,500 | $50.00 | $500,000 |

A time-based vesting would have created a taxable income of $125,000 from RSUs per year over 4 years. Double-trigger RSUs, on the other hand, would create $500,000 of taxable income in a single year.

This might mean the difference between some of the money being taxed at a lower rate and some being taxed at a higher rate, as well.

You May Not Withhold Enough Income Tax

Your company will generally withhold at a 22% statutory Federal income tax rate when your RSUs vest. For income that exceeds $1,000,000, the withholding is 37%.

In years when you have a taxable event of double-trigger RSUs and a higher income, it makes sense to evaluate whether or not you withheld enough for income tax or not. For example, if your company withholds at 22% and the bulk of your newly vested RSUs is actually taxed at 37%, you may still owe 15% at tax time due to under-withholding.

If you find you have not withheld enough for income tax, it may make sense to sell additional stock shares to cover a pending tax liability. You may also consider making an estimated tax payment.

You Should Look at Your Incentive Stock Options, Too

If you have unexercised ISOs, the year in which your double-trigger RSUs will be taxed may be a great year to exercise and hold your shares. This is because receiving your RSUs would push your taxable income higher in that calendar year, and you could have more room to exercise and hold incentive stock options without reaching the alternative minimum tax (AMT) crossover point.

Generally speaking, as your ordinary taxable income increases (as it would in the double-trigger event detailed above), so too does the spread between the regular tax calculation and the tentative minimum tax calculation. That might allow you to exercise and hold more ISOs and pay less AMT.

Make a Plan to Manage Your Double-Trigger RSUs

If you work for a private company and are issued RSUs, you may want to look at your grant agreement to see if a double-trigger provision exists. If so, take note of what provisions are in place to determine when and how your RSUs may be delivered to you.

With this information, you can more accurately plan for your RSUs, your income, and your other goals and objectives.

0 Comments