You might not give much thought to the equity compensation you receive throughout the year (until you’re forced to take action with it). But even if you do have a long-term plan in mind, it’s smart to pause periodically and review the overall strategy.

The end of the year is a prime opportunity for this review, and also provides a chance to check-in and recall any decisions made during the calendar year. Not only will this allow you to stay abreast of your current situation, but it may also be the right time to implement decisions that could have a material impact on your investments, income tax, and cash flow this year or the next.

Here are 9 considerations to keep in mind during a year-end review of your equity compensation.

1 – Take Stock of What You Have (and What You Have Done)

The end of the year is a good time to take an inventory of your equity compensation package. This may start with a simple review of what’s included.

Do you have incentive stock options, non-qualified stock options, restricted stock units, an employee stock purchase plan, or stock appreciation rights? Know what you have and make sure you have a basic understanding of the rules and important information around each type of equity comp in your package.

Next, consider a more detailed review of individual grants. Individual grant reviews can provide you with more granular detail such as vesting dates, expiration dates, exercise price, and other key information.

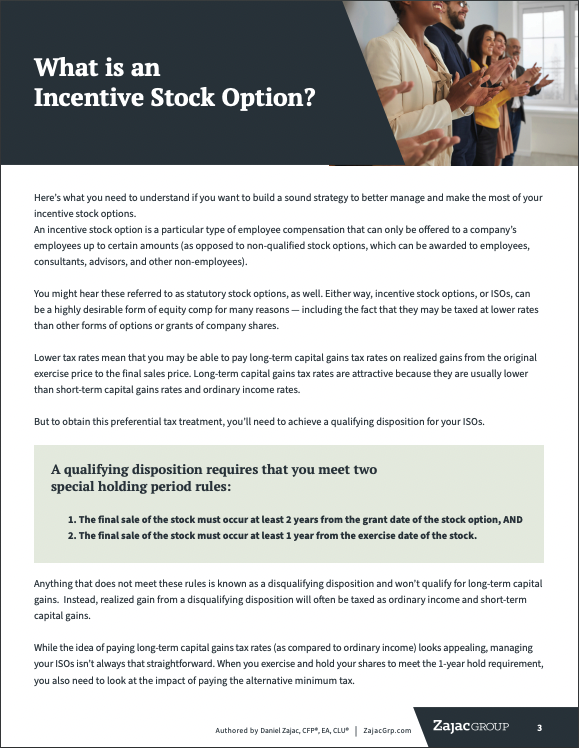

FREE GUIDE

The Ultimate Guide to Incentive Stock Options

Learn the ins and outs of incentive stock options so you gain a better understanding of what you have.

Grant information may also lead you to explore your previous exercise history, any AMT that might be due or any AMT credits coming back to you, vesting history, and current stock owned outright.

This year-end process is about understanding what you have, what you can do with it, when you can do something, and what planning opportunities may arise. You can only make sound decisions around properly coordinating your equity compensation with your financial plan if you know what you have and what actions you’ve already taken.

2 – Exercise Incentive Stock Options Shares Up to the AMT Crossover Point

If you hold in-the-money incentive stock options and do not expect to owe alternative minimum tax when projecting your tax return, you may want to consider exercising your ISOs so that the bargain element is just enough that your tentative minimum tax is equal to your regular minimum tax.

The net result of this transaction means that you will exercise and hold just enough ISOs that you will not owe AMT.

One benefit of this AMT crossover strategy is that you begin the holding period requirements to achieve a qualifying disposition of your exercised-and-held ISOs. A second benefit is that you do so without the commonly-required cash outlay required if you exercised ISOs to cover the AMT.

Keep in mind there is risk associated with this strategy. Even though you may not owe AMT on this type of exercise, you will be required to pay for the exercise cost of the shares themselves. This requires you to put cash (or its equivalent) into the transaction — and in theory, you could lose that money if the stock price drops in value.

You should also be aware that this strategy may or may not make a material impact on how many ISO shares you have exercised and held, versus how many you control. If you have a lot of ISOs, this may only allow you to exercise a few of them, but it does provide the benefit of beginning the holding period for a qualifying disposition.

3 – Sell Incentive Stock Option Shares That Are Down in Value

Year-end is a good time to review the current value of any incentive stock option shares that you exercised and held early in the calendar year.

If the prevailing fair market value of the stock is lower than fair market value on the date you exercised, you may want to evaluate the opportunity to sell these shares and intentionally create a disqualifying disposition.

When you exercise and hold, the bargain element is a determining factor in whether or not you owe AMT. If the bargain element is big, it may lead to a large AMT bill.

But if the stock price drops between the time you exercise and the end of the year, you may find yourself wishing that you hadn’t exercised because the cost of the AMT is going to unaffordable (or, at the very least, undesirable).

Assuming this is the case, selling the shares that were exercised and held early in the calendar year will “undo” the AMT preference item requirement and eliminate your AMT bill. Selling in this scenario leads to a disqualifying disposition, and you will likely need to pay ordinary income tax on the spread between the exercise price and the final sales price of the stock.

While paying ordinary income may not seem as desirable as paying long term capital gains, a falling stock price post-exercise and the ability to undo AMT might create a situation where it could be just the right opportunity for bigger-picture income tax planning and cash flow planning.

4 – Review the Possibility of Accelerating an AMT Credit

The alternative minimum tax is a bit like a prepayment of expected income tax on your exercised and held incentive stock options. But this prepayment often requires you to pay more in taxes than you otherwise would have, leading to a net cash flow.

Eventually, when you sell your ISO shares in a qualifying disposition, you might have the opportunity to receive your AMT back in the form of a credit.

If you have qualifying ISO shares, the end of the year could be a good time to evaluate whether or not you should sell those shares. Selling the shares may not only result in reduced position in company stock and a positive cash inflow from the proceeds, it may result in receiving your AMT credit back sooner rather than later.

5 – Review Your Strategy for Vested Restricted Stock and Exercised Non-Qualified Stock Options

Generally speaking, when restricted stock units (or awards) vest and you exercise non-qualified stock options, each type of compensation is taxed as ordinary income and paid to you via a cashless transaction.

A cashless transaction means that the value of the unit or option is paid in company stock, after subtracting some amount for income tax withholding (usually 22%). But you don’t need to keep the shares simply because the value of the equity compensation was paid to you in shares.

The end of the year is a good time to evaluate whether or not you should keep those shares, or sell them.

If you want to limit your concentrated position in a single stock, selling shares obtained during the calendar year may be an attractive strategy. If the prevailing market price is near the price at which the shares vested or were exercised, the additional tax implications to sell may be minimal as you only need to pay capital gains (loss) on the amount in excess of the cost basis.

From a cash flow standpoint, this may mean you will receive nearly the full proceeds of the sale. You can then use these proceeds to address some of your other financial planning goals and objectives.

6 – Consider Liquidating ESPP Shares

Much like RSU and NQSOs, you should evaluate your ESPP at year-end. Participation in a good ESPP that offers a discount on the purchase price and a lookback provision can be a good reason to participate in the plan to your fullest capability.

Retaining company stock in an effort to achieve a qualifying disposition and preferential tax treatment, on the other hand, may or may not be as attractive as it seems. To do so, you have to hold the ESPP shares for at least a full year after receiving them, which subjects you to the market risk of owning a single stock.

Consider your ESPP strategy and how much you currently participate. Do you need to make adjustments to bring that strategy in line with your overall financial plan or risk tolerance? Should you retain or sell your ESPP shares to accomplish that?

These are important questions to ask when reviewing your current use of an ESPP.

7 – Evaluate the Opportunity to Accelerate Income into This Calendar Year

If you find yourself in a low-income tax year, or expect to be in a significantly higher tax bracket next year, it may make sense to accelerate some of your income into this calendar year. Generally speaking, accelerating income can be accomplished in two ways:

First, you can accelerate income by exercising non-qualified stock options.

When you exercise NQSOs, the bargain element is treated as compensation income in the year of exercise. Another consideration may be to exercise and sell your ISO as a disqualifying disposition. This transaction may also have the impact of accelerating ordinary income into this calendar year.

A second option may be to sell previously held stock.

If you hold shares that have experienced a long-term capital gains outright, selling those shares may mean you are able to capture the gains at a preferential tax treatment. If your income is low enough, your long-term capital gains may not be taxed at all.

8 – Evaluate Your Projected Income Tax Due (and See If You Might Get a Refund)

In a year that you have restricted stock that vests and/or stock options that you exercised, projecting and paying income tax can be complicated. Year-end can be a good time to project your tax return to see if you have paid enough tax to cover your tax bill.

To do so, you might want to consider a few things:

First, you should calculate what you expect to owe in income tax for the year. This may include income tax from RSUs and NQSOs that will be subject to ordinary income tax treatment, or from AMT and/or capital gains taxes more commonly associated with ISOs.

Once you know what your tax bill is projected to be, you can determine if you have withheld enough via payroll deductions and estimated tax payments to cover the projection.

Companies will often withhold income tax on RSUs and NQSOs at a statutory federal income tax rate of 22%. (With ISOs, you usually won’t have any money withheld from your paycheck.) This may or may not be enough to cover your total tax bill, so this is important to figure out even if your company already withheld some money from your salary.

If you feel as though you underpaid your income tax, you may want to make an estimated tax payment to cover the need, or set aside cash to pay the tax due when your return is prepared.

9 – Plan for Next Year

As part of a year-end review, you might want to evaluate whether or not you have RSUs that vest, stock options that are set to expire, or ISOs that will meet the qualifying disposition standard.

If you understand what is expected and project a future tax return, it may lead to planning opportunities such as coordinating equity compensation with other employee benefits like a nonqualified deferred compensation plan, or an increase in your current 401(k) deferral rates.

This may also lead to opportunities around cash flow planning. If you expect a large sale of stock or a large vesting of RSUs, you want to plan for what you will do with the proceeds. This is where proactive financial planning may come in to play.

If You Want to Make the Most of Your Equity Comp, Plan a Year-End Review

Year-end planning for equity compensation is more than an arbitrary timeline at which to review your needs. It’s a time when income tax, cash flow, and investment risk can all be materially impacted by decisions (or non-decisions) prior to the close of business on December 31.

While the list above is not a complete list of planning considerations, it does provide a primer in to some of the things you may want to consider.

Keep in mind, however, that each one of these topics can be complicated, and by combining several into a coherent plan may require the skills of an accountant, a financial planner, an investment guru, and most important your personal goals and objectives.

0 Comments