Have you been offered Non-Qualified Stock Options (NQSOs) as part of your employee benefits package? If so, that’s good news. NQSOs can lead to substantial payouts if your company does well. And if it doesn’t do well, you aren’t obligated to buy into any shares.

That said, non-qualified stock options are not the same no-brainer benefit as a raise or cash bonus. There are additional tax, investment, and financial planning implications to think about. Here are 10 key NQSO insights worth knowing as you proceed.

1 – Non-Qualified Stock Options Are Not Taxed at Grant

Being granted NQSOs simply means your company is giving you the right (or option) to buy a set number of its stock shares at a set price (the “strike price”). The grant, by itself, is not a taxable event.

You will want to make a note of the grant date; it will factor into your planning when (or if) you exercise your options later on.

2 – Non-Qualified Stock Options Are Not Taxed When They Vest

In addition to the grant date, you will want to take note of the vesting schedule. The vesting schedule will detail when you can take unencumbered delivery of the shares of stock when you exercise them.

If you choose not to exercise your NQSOs when they vest, there is once again no taxable event. Only once you exercise your options do you become an actual company stock shareholder, with associated tax ramifications. You can exercise and take delivery of stock shares at vesting, but you don’t have to. You can instead wait and exercise some or all of your shares after vesting, but before your options expire.

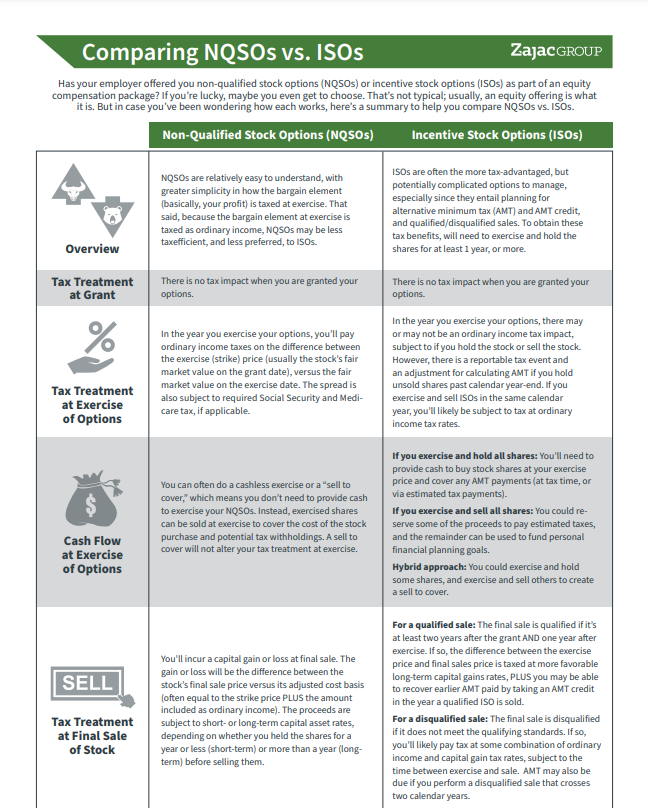

NQSOs vs. ISOs

This summary will break down the differences in how they work and what you should consider.

As an addendum, some companies may allow for an early exercise of NQSOs, which allows you to exercise your options before they vest. An early exercise is often coupled with an 83(b) election as a tax-saving strategy

3 – You Create a Taxable Event When You Exercise Your NQSOs

When you do exercise your NQSOs, you’re buying shares of stock at the strike price you were offered at grant. This is a reportable event for income tax purposes. Specifically, the taxable amount (commonly known as the bargain element) is calculated as follows:

Number of NQSOs Exercised x (Fair Market Value at Exercise – Strike Price) = Taxable Income

Using hypothetical numbers to illustrate, lets assume you have 10,000 NQSOs with a strike price of $1 per share, and a fair market value exercise price of $50 per share. Following our formula above, we can calculate the following:

10,000 exercised NQSO x ($50 – $1) = $490,000 taxable income

This bargain element is taxed as ordinary income and subject to Social Security and Medicare taxes. This means the taxable element shows up in boxes 1, 3, and 5 of your year-end W-2, in the year you exercise your options.

4 – How to Pay Tax When You Exercise Your NQSO – Part 1

As just described, it’s relatively easy to calculate taxable income on exercised NQSOs, especially compared to incentive stock options. That said, the process by which tax is paid may not be so clear.

Continuing the example above, we assume a taxable income of $490,000. At exercise, income tax is often withheld at a federal statutory rate of 22% (in addition to other applicable taxes).

Assuming a flat, statutory tax rate of 22%, your federal tax withholding = $107,800.

Statutory tax withholding is often addressed via “net-settlement,” aka “sell-to-cover” at exercise. These effectively let you simultaneously exercise and hold some options, and exercise and sell others, creating the requisite cash via the sale to cover the tax due. In this example, we calculate the following:

Total Cost / FMV at Exercise = Shares for “Sell-to-Cover”

$107,800 / $50 = 2,156

5 – How to Pay Tax When You Exercise Your NQSO – Part 2

Statutory withholding may or may not be enough to cover your total tax due. If your taxable income is significantly higher in the year you exercise your options, you could incur higher marginal tax rates (up to 37%) and thus an even bigger tax bill.

Continuing our example from above, let’s assume that you are in fact in a 37% federal tax bracket, and that you withheld at the 22% statutory rate at exercise. In this example, you are “under-withheld” by 15%, and you may want to plan for this.

To illustrate, we can assume:

Federal Tax Liability x Taxable Income = Federal Tax Due

Using our numbers:

37% x $490,000 = $181,300

Federal Tax Due – Statutory Tax Withheld = Additional Tax Due

$181,300 – $107,800 = $73,500

In this scenario, there is an additional $73,500 tax due to cover the total tax bill generated by the exercise of NQSO. One method for covering the additional tax is to sell more shares. At $50 per share, you would need to sell 1,470 shares. After withholding 2,156 shares at exercise and selling an additional 1,470 more, you’ll be left with 6,374 shares, or a total value of $318,700 (assuming $50 per share).

6 – You May Owe Additional Tax Later When You Sell Your Shares

So far, we’ve covered tax ramifications of exercising your NQSOs. Then what? If you hold shares post-exercise, only to sell at a future date, any profit (or loss) you incur on that future sale will be treated as a capital gain (or loss) for tax purposes.

If we continue with our example above, you’d retain 6,374 shares valued at $50 each, or $318,700. This $50/share (the FMV at exercise) value represents these shares’ cost basis, used to calculate any future capital gains or losses.

- When you sell any shares for more than the $50 per share basis, you’ll incur a taxable capital gain; if you sell any shares for less than $50/share, you’ll create a capital loss you can use to offset gains.

- Capital gains on shares held more than a year are taxed at more favorable long-term gain rates.

- Capital gains on shares held a year or less are taxed at short-term rates, which are currently the same as ordinary income tax rates.

All else being equal, it would make sense to seek long-term capital gains. However, holding shares for an extra year means retaining investment risk—i.e., the risk that the share value could tank on you. A substantial investment gone bad could cost you significantly more than the taxes saved.

As such, taxes aren’t the only factor to consider in deciding whether to exercise your NQSOs sooner or later. It may not even be the most important factor. Which brings us to our next point.

7 – NQSOs Might Leave You Vulnerable to Concentration Risk

As your stock options increase in value, they can become an increasingly larger portion of your net worth. Having too much of your wealth tied up in one stock exposes you to concentration risk, or the risk that one bad break could wipe out too much of your money all at once.

If you are willing and able to essentially bet big on your company stock, you may decide to accept a high degree of concentration risk is reasonable. If even a total loss wouldn’t hit your overall financial well-being too hard, you may opt for this longer shot.

On the other hand, what would you do if the value of your company stock dropped 50%, say, from $2 million to $1 million? If the impact of losing $1,000,000 would be devastating to you—such as if you are nearing retirement, or otherwise heavily depending on keeping profits you’ve already achieved—it may be time to reduce your concentration risks.

A rule of thumb: If your company stock + options (or any other single position in your portfolio) exceeds 10–15% of your wealth, you may be exposed to concentration risk.

8 – Your Shares Will Eventually Expire If Unexercised

NQSOs are not a right into perpetuity. They come with an expiration date, which is often 10 years from the grant date. If you don’t exercise your options before they expire, they simply go away—as will any potential value associated with them. (You will get to keep any already-exercised, unsold stock shares.)

One strategy is to wait to exercise your NQSOs until their expiration date approaches, to delay a taxable event and to benefit from time and leverage. As we’ll cover next, there are times when this strategy may make sense. But don’t wait too long. You don’t want the options to expire on you before you’ve made your move.

9 – There Are Multiple Strategies for Exercising Your NQSOs

So, how do you decide when to exercise your NQSOs? The right strategy for you is the one that offers you the highest likelihood of successfully meeting your personal financial goals.

As the expiration date nears: Again, one option is to wait to exercise until your options are about to expire. At that point, you can clearly identify their current value, you’ll know how much tax you’ll owe, and you’ll know they’ll soon be worthless if you don’t exercise them soon.

When the price seems right: Obviously, the best time to exercise your options is when the stock price is at its high point. Unfortunately, even professional investors are rarely able to identify when a stock is at or near its peak price. We usually only know that in hindsight. As such, this strategy can leave you far less confident of when the time really is right.

When you’ve achieved “enough”: A more realistic strategy may be setting an “enough” value that meets your personal aspirations, and then exercising your shares when you reach that bar. Your “enough” may be the amount required to live the retirement you want to, or to buy the beach home you’ve always dreamed of, or whatever. It will also be important to actually exercise your options when the time comes, rather than convince yourself you now need more than enough. Enough is all about determining what is important to you through personal goal-setting and accountability.

According to an automatic process: A happy medium might be reached by establishing an automated schedule for exercising a set number or value of shares each year. Using our 10,000 option example, you could decide to exercise 2,000 shares per year, for five years, on July 1st of each year. This strategy removes emotion from the process, spreads the tax hit over several years, and averages the price at which you exercise your shares. (With this approach, you may want to add a rule about only exercising if the share value exceeds the strike price, with protocols for what you’ll do instead if it does not.)

Letting taxes lead the way: Finally, if minimizing taxes is your top priority, an early exercise is likely to make the most sense. By exercising early, and then holding the shares for more than a year, any future growth can be taxed as long-term capital gains rather than short-term or ordinary income. However, in most circumstances, a tax-forward NQSO strategy may not be your most favorable approach.

Mix and match: Your strategy doesn’t have to be all or nothing. You may find your best approach by combining several of the concepts just described.

10 – Non Qualified Stock Options Are Not a Sure Bet

For stock options to have value, the stock price needs to be higher than the strike price at which you can buy the shares. While this is what anyone with stock options hopes for, it doesn’t always happen. In fact, stocks are inherently volatile, so it’s not uncommon for the share price to drop below your strike price. When this occurs, your options won’t be worth anything, at least not unless the share price recovers.

To manage the risk of your NQSOs or executed shares becoming worth less—or even worthless—logic once again points to having a sound strategy for exercising your options and selling the stock shares on a timely basis, guided by your personal financial goals. This includes planning for how much of the after-tax proceeds you will spend, save, and/or reinvest in a more diversified investment portfolio for future potential growth. In other words, it includes ongoing financial planning and investment management.

In Summary

With these 10 points, you’ve now got a great head start on key factors to consider as you manage an NQSO offer from your employer. If we leave you with the most important point of all, we would say it’s the value of evaluating your options through your own tax, investment, and financial planning lens.

For that, we invite you to continue your journey by exploring the rest of our website content, and signing up for our ongoing newsletters. MyStockOptions.com is another good resource to turn to.

Still thirsting for more? Our firm offers additional support, with specialized experience in blending the varied issues involved in managing NQSOs and other forms of equity compensation. Hiring the right “who” can elevate your ability to develop a plan and a strategy that makes the most sense for you and your life. If we can assist further with that, please be in touch.

Is a firm required to disclose the FMV to you prior to making the decision to exercise the NSOs? Otherwise, I won’t know if my tax bill will be $10 or $100,000.