When it comes to evaluating strategies to exercise your Non-Qualified Stock Options (NQSOs), what is your best plan of attack? Do you …

- Exercise and sell all your NQSOs immediately, cashing out the full proceeds?

- Exercise your NQSOs and hold shares of stock, hoping the stock price will go up?

- Or, leave your NQSOs unexercised and hope the stock price will go up?

If you anticipate a higher stock price in the future, you might assume it makes the most sense to exercise and hold your NQSOs sooner than later; this starts up the holding period on your stock, so you can hope to pay preferential long-term capital gain (LTCG) taxes on any post-exercise gain when you do sell.

Unfortunately, this LTCG-focused strategy may not prove to be the best for NQSOs. In fact (and all else being equal), you might be better off waiting to exercise your NQSOs until you’re also ready to sell the stock, even knowing that you’ll incur higher ordinary income tax rates on the full proceeds.

To understand why calls for a closer look at how NQSOs are taxed and how they settle at exercise, especially compared to Incentive Stock Options (ISOs). The differences will help inform why different types of employee stock options may warrant different strategies. While an exercise and hold of ISOs might make a lot of sense, the same logic might not be so beneficial if you have NQSOs.

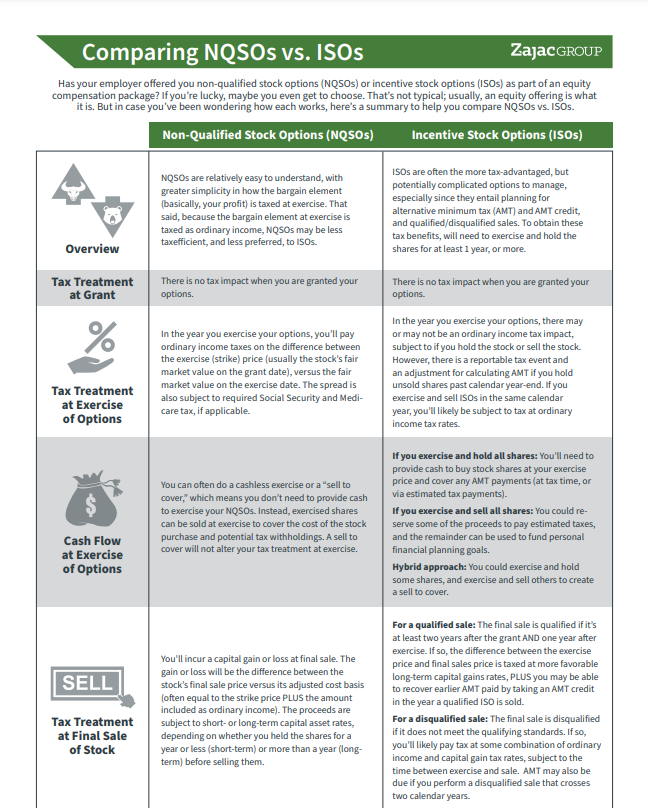

Incentive Stock Options vs. Non-Qualified Stock Options

First, let’s take a look at some important distinctions between ISO and NQSO tax treatments at exercise and at final sale. This will help us understand why an exercise and hold of ISOs is potentially financially superior to an exercise and hold of NQSOs.

For ISOs: There is NO ordinary income tax impact or tax withholding at exercise. (There is, however, an AMT adjustment if you hold the stock past the year-end.) When you exercise your ISOs, you often take ownership of the gross number of options exercised. In addition, when you sell shares later, you can capture long-term capital gains on the full spread between the ISO’s strike price and the final sale price of the stock, as long as you do a qualifying disposition (selling your stock at least 2 years after the offer date and 1 year after the purchase date). These logistics can make it particularly attractive to perform an exercise and hold of ISOs, and achieve LTCG tax treatment.

NQSOs vs. ISOs

This summary will break down the differences in how they work and what you should consider.

For NQSOs: There IS a reportable ordinary income tax event at exercise. There is also a required tax withholding at exercise, and then a second reportable tax event when you sell your shares. However, only the difference between the fair market value (FMV) at exercise and the final sales price is eligible for LTCG tax treatment.

Particularly important about the exercise of NQSOs, and materially different than ISOs, is that you often end up owning less shares of stock post exercise than gross options exercised. (More on this later.)

Although holding fewer post-exercise shares offers some downside protection should the share price fall before you sell (as compared to holding unexercised non-qualified stock options), it also reduces the upside potential should the share price rise. And this upside potential of retaining unexercised NQSOs can yield well more than waiting for the LTCG rate on a fewer number of exercised and held shares.

This often ultimately means:

If you anticipate the stock price will increase, it usually makes more sense to wait to exercise and sell your NQSOs in a single event (even knowing you will pay ordinary income tax at the exercise and sell), as compared to exercising and holding a net-settled number of shares, with the hopes of selling later and paying at LTCG rates.

Let’s show you how it all works.

How Are NQSOs Taxed and Settled at Exercise?

NQSO tax treatment is relatively straightforward. In the year you exercise your options, you’ll incur ordinary income taxes, plus any applicable payroll taxes such as Social Security and Medicare. These taxes are assessed on the spread between the strike price of the NQSO and the Fair Market Value (FMV) at exercise, multiplied by the number of NQSOs you exercise:

(FMV at Exercise – Strike Price) x NQSOs Exercised = Taxable Income at Exercise

But generally speaking, when you exercise a NQSO, you’ll actually receive a net settlement of shares … after some of them are withheld to cover taxes due and cost of purchasing shares. Under current tax codes, a statutory federal withholding at exercise is usually 22%, although it may be 37% for supplemental income in excess of $1 million.

Either way, you will own fewer shares post-exercise than the pre-tax options you controlled pre-exercise.

To illustrate, let’s assume the following:

- NQSOs: 10,000

- Exercise Price: $20

- FMV at Exercise: $50

- Statutory Withholding 22%

In this scenario, the number of NQSOs controlled, unexercised, is 10,000. Here’s what a net exercise of these options would look like, adjusting for a statutory withholding of 22% and Medicare tax of 1.45% (assuming you are past the Social Security wage limit at exercise):

| Cost to Exercise (NQSO Exercised * Exercise Price) | ($200,000) |

| Taxable Income (Bargain Element) | $300,000 |

| Tax at Exercise | ($70,350) |

| Total Cost | ($270,350) |

| Shares to Cover (Total Cost / FMV at Exercise) | 5,407 |

Post exercise and hold, you control 4,593 shares of stock, or less than half of the stock you controlled pre-exercise.

How Are NQSOs Taxed After Exercise?

After you’ve exercised your NQSOs, the cost basis per share equals the share price at exercise. When you sell those shares, you’ll be taxed on the gain/loss between their final sale price and their cost basis:

Final Sales Price – Cost Basis = Capital Gain/Loss

This means, if you exercise and immediately sell all your shares, you won’t incur additional taxes, assuming the final sale price and cost basis are the same. If you hold your shares for a while before selling them, they’ll be taxed as a capital asset subject to short- or long-term capital gains treatment. Assuming a gain:

- LTCG Rate: If you hold shares for more than a year after exercise, their sale is taxed at LTCG rates.

- Ordinary Income: If you hold them for a year or less, their sale is taxed as a short-term sale, subject to ordinary income tax rates.

Comparing NQSO Exercise Strategies

With an understanding of income tax, net-settlement, and capital gains, we can compare possible outcomes of two NQSO strategies, including a timeline of events. In our first scenario, we’ll complete a net settled exercise and hold. We’ll exercise on Day 1 at the strike price, and when the FMV is $50 per share. We’ll hold the stock for just over 1 year, subsequently selling the shares at $85 per share and receiving preferential LTCG tax treatment.

In the second scenario, we’ll simply wait, as we propose, leaving the options unexercised until we do a full exercise and sell at $85 per share, incurring higher ordinary income tax rates on the full profit.

The comparison will illustrate, by waiting to exercise and sell, whilst paying higher tax rates, the after-tax proceeds are higher than exercising and holding NQSOs and achieving preferential LTCG rates—all because waiting gives us control over a greater number of options that benefit from a rising stock price.

Hypothetical Assumptions

- NQSOs: 10,000

- Strike Price: $20

- 32% personal marginal tax rate (22% statutory withholding + 10% higher personal marginal rate)

- FMV at Exercise: $50

- Final Sale Price: $85

Scenario 1: Exercise and Hold, to “Get Long-Term Capital Gains”

In our exercise and hold scenario, we’ll exercise all options upfront, sell some exercised shares right away to cover the exercise cost and taxes due, pay marginal ordinary income tax rates on the sold shares, and hold the rest until they qualify for LTCG rates. In summary, here’s how that plays out:

- Exercise 10,000 options at $20 per share, when the FMV is $50

- Sell 5,920 shares at $50 per share to cover the cost of exercise and the tax due

- Hold the 4,080-share balance for more than a year; sell at $85 per share and 15% LTCG rates

- Total after-tax proceeds: $325,380

Scenario 2: Wait to Exercise, and Then Exercise and Sell (Without LTCG Tax Savings)

To compare and contrast, an alternative strategy is to NOT exercise, leaving the options untouched until the share price is $85 per share, and then exercise and sell. Notably, even though all profits are taxed as ordinary income, you may end up in a better spot. To review:

- Do not exercise and hold at $50 per share

- Exercise all 10,000 options at $85 per share

- Immediately sell all 10,000 shares at $85 per share and 32% ordinary income tax rates

- Your total pre-tax profit is $650,000, with $208,000 taxes due

- Total after-tax proceeds: $442,000 (or 36% greater wealth)

Here is a more detailed breakdown of each scenario:

| Options Exercised | 10,000 | |

| Strike Price | $20 | |

| FMV of Stock at Exercise | $50 | |

| Future Price | $85 | |

| Marginal Tax Rate | 32% | |

| LTCG Rate | 15% | |

| Net Exercise Now Sell Later at LTCG Rate |

Hold and Wait Exercise/Sell at Future |

|

| Options Exercised | 10,000 | 10,000 |

| Exercised and Held | 4,080 | – |

| Exercised and Sold | (5,920) | 10,000 |

| Gross Value | $500,000 | $850,000 |

| Cost to Exercise | ($200,000) | ($200,000) |

| Taxable Income (Bargain Element) | $300,000 | $650,000 |

| Tax Due at Exercise | ($96,000) | ($208,000) |

| Total Cost | ($296,000) | ($408,000) |

| Proceeds of Shares Sold | ($296,000) | $850,000 |

| Net Cash Flow | $442,000 | |

| $442,000 | ||

| Value of Shares Held | $204,000 | |

| FV of Shares Held | $346,800 | |

| LTCG Tax | ($21,420) | |

| After-Tax Proceeds | $325,380 | $442,000 |

What If the Share Price Is Down?

Well, sure, you may be thinking. This works out well when the stock price is up. But what if it’s down? You might assume it would make sense to perform a net exercise and hold sooner than later, since you’d be buying the stock “low” and capturing more upside at LTCG rates. The ordinary income tax impact at exercise would also be lower than it would be if the stock price were higher.

However, you will hold far fewer shares of stock after a net exercise when the price is low. So, leaving your options unexercised offers much more leverage and upside as compared to LTCG tax rates on fewer shares.

Continuing our example, lets assume that the FMV at exercise is $25 per share. In this scenario, assuming you exercise 10,000 NQSOs, 8,640 are required to cover the cost and taxes due, and 1,360 shares will be held outright, a reduction of over 85%.

If the final sales price is still $85 per share, the total net proceeds is $103,360, or less than 25% of the Scenario 2, and by far the lowest after-tax outcome in our hypothetical illustration.

If you remain unconvinced, it’s worth asking yourself: Is exercising my NQSOs the highest and best use of the capital it will take to buy the stock via the option, or is there a better alternative? Said another way, what if, instead of exercising options when the share price is down, you use that same money to buy additional shares on the open market, and leave your NQSOs unexercised and untaxed? In this scenario, you’d control a greater number of shares, giving you even more upside potential moving forward.

A Sidebar on 83(b) Election for Early Exercise of Pre-IPO NQSOs

Waiting to exercise and sell your NQSOs isn’t for everyone. For example, when it’s available, early exercise of your NQSOs, coupled with an 83(b) election could be a good idea for very early-stage companies whose shares have a low strike price with little to no gap between FMV and strike. This might allow you to buy shares at a low cost, with minimal tax impact, and initiate the holding period requirement on selling at LTCG tax rates.

However, there’s a sidebar to this sidebar: Keep in mind, you may need to hold your exercised, pre-IPO shares for a long while before there’s a market in which you can sell them; in fact, that market may never materialize, putting you at substantial risk of loss.

All Things Considered: When Holding NQSOs, Think Beyond LTCG Tax Rates

So, we’ve now demonstrated, LTCG tax rates are not the only factor influencing whether to exercise and hold your NQSOs, or exercise and sell simultaneously later on. In fact, taxes may not even be the most important factor in the equation.

Remember, sacrificing a significant number of shares in a net-settled exercise also means giving up their future potential value—for better or worse.

To avoid any regret over paying higher taxes at the time, think of it as being similar to the tax hit you take whenever you receive extra ordinary income, such as a bonus. Paying higher taxes on more money in your pocket may not be such a bad tradeoff, after all.

When exercising and holding NQSOs, it’s not a given that a NQSO holder will need to sell shares to cover the cost of the purchase & the taxes. Many executives have cash to pay for the shares and taxes. I’ve never personally sold shares to cover these costs. Covering both scenarios would’ve presented a more complete picture, imo.

Hi Karen – Agreed, you may be able to pay for these costs out of pocket and retain all the shares. If you are an executive (or other) with the resources to do so, this is certainly a possibility.

One consideration is opportunity cost. Said another way, does it make sense to use cash on hand to cover the cost to exercise and hold? Or, alternatively, would a preferred outcome be to use that cash to buy another investment (maybe additional shares of stock, maybe a diversified portfolio, maybe something else?), all the while retaining the NQSO unexercised (assuming that they are not set to expire). Its a complicated question by itself, not to mention the possibility of increasing single stock concentration when paying for the exercise costs out of pocket.

Thanks for the note. I like idea of expanding on this article and addressing your comment. Stay tuned