Are you considering exercising your incentive stock options (ISOs) this year? Before deciding, it’s important to consider the potential tax implications of when and how to proceed.

In terms of “how,” some potential strategies include:

- Exercising well before the ISOs are set to expire

- Exercising as expiration nears

- Exercising on some other schedule

You can learn more about these specific strategies here.

All of these, and more, are viable paths to take. The right strategy for you depends on your circumstances, goals, and objectives.

Now, let’s talk in terms of “when,” as that’s what we’ll focus on below. More specifically, how exercising ISOs earlier in the calendar year may present some distinct tax advantages.

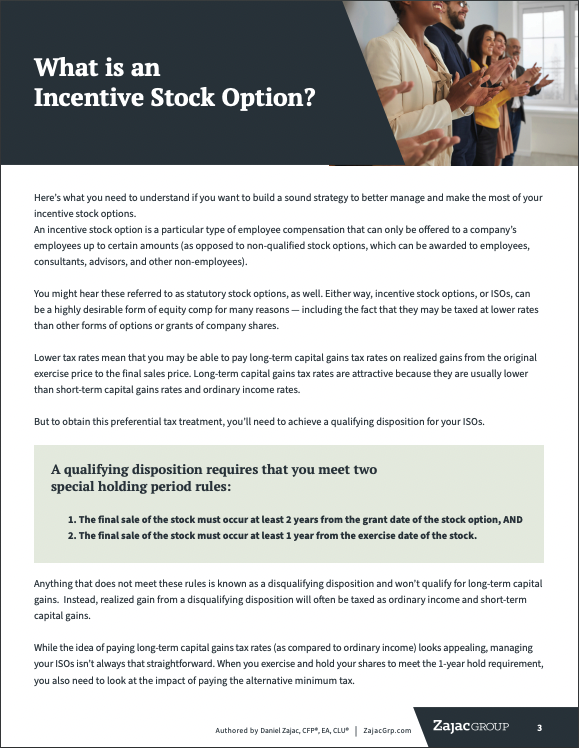

First, a Reminder About ISOs and AMT

In the years you exercise and hold your ISOs, you may be more likely than usual to qualify for the alternative minimum tax (AMT). As a quick reminder, taxpayers will owe AMT if their “tentative minimum tax” (TMT) exceeds their regular tax bill.

FREE GUIDE

The Ultimate Guide to Incentive Stock Options

Learn the ins and outs of incentive stock options so you gain a better understanding of what you have.

When you exercise and hold ISOs, the bargain element is included as an adjustment item when calculating the TMT. “Bargain element” refers to the spread between the exercise price of your stock option and the fair market value (FMV) of the stock at exercise—multiplied by the number of options exercised.

Learn more about the correlation between ISOs and AMT here.

When You Exercise Your Incentive Stock Options Matters

When you exercise your incentive stock options, the calculation to determine if and how much alternative minimum tax (AMT) you could owe is based on a calendar year.

If you exercise your ISOs and hold the shares past that year’s calendar end, the bargain element needs to be included as a tax preference item on your tax return for the year of exercise. The potential problem is that the exercise and hold of incentive stock options may create a significant AMT bill.

For example, if you exercise your ISOs in July 2025 and hold the shares beyond December 31, 2025, the bargain element needs to be included when calculating your TMT for the 2025 tax year. By April 2026, you could face a significant AMT tax bill.

Now the question is, how does timing potentially reduce, mitigate, or manage that large AMT bill when exercising ISOs?

1 – If you exercise your ISOs early in the calendar year and sell these shares the following year as a qualified disposition, you can capture long-term capital gains and pay your AMT bill from the proceeds. For this to work, you’ll need to sell before April 15 of the following year (when this year’s final tax bill is due).

Quick reminder, a qualified disposition must meet the following criteria:

- The final sale of the incentive stock options shares occurs at least two years after the grant date, AND

- The final sale of the incentive stock option shares occurs at least one year after the incentive stock option was exercised.

2 – Exercising early also gives you the opportunity to undo your exercise should the your exercise should the stock price decrease in value from exercise and you want to sell the stock to avoid AMT.

Combine these benefits with a desire to diversify your assets to avoid overexposure to concentration risk. You may find the best time to exercise is early on during the calendar year.

Example of AMT on Exercised ISOs

If you have substantial incentive stock options and want to achieve the tax benefits of a qualified disposition, you may not be able to avoid paying AMT forever. In fact, delaying your decision to exercise may not entirely avoid AMT — it simply kicks the can down the line. Plus, waiting to exercise could cause you to owe even more in AMT if the stock price continues to appreciate.

But putting aside any aversion you may have to paying a potentially high tax bill, you might just not have the cash on hand to cover it.

Let’s take a look at an example of what an AMT tax bill could look like on ISOs exercised this year.

If you exercise and hold shares from 10,000 ISOs with a strike price of $1 and a current market price of $50, your bargain element will be:

Bargain element = (FMV at Exercise – Strike Price) X Number of Options exercised

= ($50 – $1) x 10,000

= $490,000

If we assume a flat 28% AMT, you will owe:

AMT = Bargain Element x Tax Rate

= $490,000 x 28%

= $137,200

You can expect to owe $137,200 in AMT when you complete your tax return the following April.

Why Exercising Your Incentive Stock Options Early in the Year May Make Sense

Clearly, a cash call of $137,200 is a significant amount of money. Instead of avoiding the exercise of your ISOs altogether, plan ahead to determine when and how you’ll pay your AMT bill.

This is why exercising early in the calendar year can be a smart move.

It creates an opportunity to pay your AMT bill with the exercised shares themselves, while still getting preferential tax treatment through a qualifying disposition.

Here’s a scenario to illustrate how this could work:

Say you exercise 10,000 ISOs with a strike price of $1 and a current market price of $50 on February 1, 2025. We know (from our calculation above) that this gives you a bargain element of $490,000 and creates an AMT bill of $137,200.

This bill may be due when you file your 2025 tax return, and of course, the deadline for your return is April 2026 (although you may want to be aware of required estimates and other tax nuances).

Fast forward one year. It’s now March 1, 2026, and you sell the shares you exercised on February 1, 2025. Here’s what you’ve just done by taking these actions on these dates:

- Assuming March 1, 2026, is at least two years from the grant date of your ISOs, you secured a qualifying disposition.

- When the proceeds of the sale of your stock hit your account, you can pull from these funds to pay your 2025 AMT tax bill due by April 2026; the timing solves the problem of having to pull from existing cash on hand to cover the AMT bill.

You could sell just enough of your previously exercised shares to cover the AMT cost (and if you had met the standard for the qualifying disposition, also obtain the preferential tax treatment). This is an alternative to selling all your stock, if you prefer to continue holding some shares.

The stock price determines how many shares you need to sell should you want to sell only enough to pay AMT. If the stock price is $50 per share, you must sell 2,744 shares ($137,200 / $50). If the stock price is $100 per share, you must sell 1,372 shares. As with most other decisions regarding the timing and strategizing of ISOs, it may help to discuss this option with an advisor first.

When Is It Too Late in the Calendar Year to Use This Incentive Stock Option Exercise Strategy?

This strategy does not work if you choose to exercise after the April timeframe.

If, for example, you exercised your shares on August 1, 2025 (instead of February 1, 2025), you would still owe $137,200 in AMT. That amount will still be due the following year in April 2026.

But if you want to enjoy the tax advantages of a qualifying disposition, then you can’t use the money from selling the shares you received after exercising your options. Why? Because remember, a qualifying disposition requires you to hold your shares at least one year past the exercise date. If you exercise later than April, you cannot meet both the tax filing time and the 1-year holding requirement.

If your priority is to achieve better tax treatment with a qualifying disposition, it’s fair to assume you will not sell. In that case, the money for your AMT tax bill will need to come from somewhere else.

As a final “out,” it is important to know that you can sell these exercised shares to pay the tax bill. You don’t have to hold the shares for at least one year. But if you sell after holding them for less than 12 months, then your gain will be taxed as ordinary income.

Exercising Early in the Year to Manage Cash Flow and Tax

Exercising your ISOs early in the calendar year is not an AMT avoidance strategy. You will need to report the bargain element and pay the AMT on the tax return for the calendar year you exercise.

What exercising early may do, however, is help you manage cash flow by allowing you to use the same shares you exercised early in the year to pay the AMT in the following year.

Because this strategy enables you to use money from the sale of stock to cover the AMT, it might also make sense to exercise a larger number of options early in the calendar year.

Yes, your AMT may be higher, but consider what you could do with the cash generated from selling shares. Not only can you use it to cover your tax bill, but you can do things like:

- Reinvest in a diversified portfolio, or

- Fund other savings goals or lifestyle needs.

If you wish to retain some shares, only sell off enough to cover your AMT bill. You’d have more exercised shares that meet the qualifying disposition standard, enabling you to turn stock into cash in a more tax efficient manner as needed.

Exercising ISOs Early in the Year Gives You an Out at Year-End

While we always hope that the stock price will go up, your stock price can go down between the time you exercise early in the calendar year and the end of the year.

In this scenario, you might owe significant AMT on the bargain element value at exercise (when the stock price was high) even though the value of your stock is down. In a worst-case scenario, the AMT bill could be more than the value of the stock itself.

Exercising early in the calendar year gives you a chance to see how the stock performs and gives you an exit should it perform poorly. The way out is to sell your exercised shares prior to the calendar year’s end as an intentional disqualifying disposition.

The benefit is that the bargain element that would have been subject to AMT goes away if you sell your shares by year-end. Your taxes owed will depend on the strike price, exercise price, and final sales price, but you will likely be paying some combination of ordinary income and short-term capital gains tax.

While both of these come at less favorable rates than the original long-term capital gains tax that you’d probably rather pay, they are potentially better than holding shares that aren’t worth much and having a big AMT bill to boot.

0 Comments