Some employers may allow you to choose how you receive your equity compensation. They may allow you to receive it all in non-qualified stock options (NQSOs) or all in restricted stock units (RSUs) or they may allow you to receive some combination of the two.

Some employers may allow you to choose how you receive your equity compensation. They may allow you to receive it all in non-qualified stock options (NQSOs) or all in restricted stock units (RSUs) or they may allow you to receive some combination of the two.

If your employer offers you a choice between RSUs and NQSOs, you may wonder which option is the best. Generally speaking, from the company standpoint, they are valued equally. But that does not mean they are valued equally to you. In fact, the choice you make may have a material impact on the long-term value of the award.

When choosing between the two, it’s important to understand key considerations. For example, RSU and NQSO have different rules about when they are taxed (RSUs at vesting, no choice) (NQSOs at exercise, choice of timing).

It’s also reasonable to assume that when offered the choice, you may get “more” NQSOs than you would RSUs. And finally, RSUs do not cost anything to purchase, whereas NQSOs do. This means that RSUs will likely always be worth something, but NQSOs need the stock price to appreciate above the exercise price to be worth anything at all.

If you are staring down on the choice between choosing RSUs or NQSOs, don’t worry, you aren’t alone. This article will provide a list of questions and scenarios that will help you decide on the best choice for your finances.

Find the Ratio Between Restricted Stock Units and Non Qualified Stock Options

If your company is offering you a choice between NQSOs and RSUs, one of the first things you’ll notice is that it is not a one-for-one tradeoff. Typically, you would receive more non-qualified stock options than restricted stock units, potentially making NQSO seem more valuable. However, the ratio of NQSO to RSU is mathematically equivalent on the date the award is granted based on technical calculations tied to a Black-Scholes options pricing model.

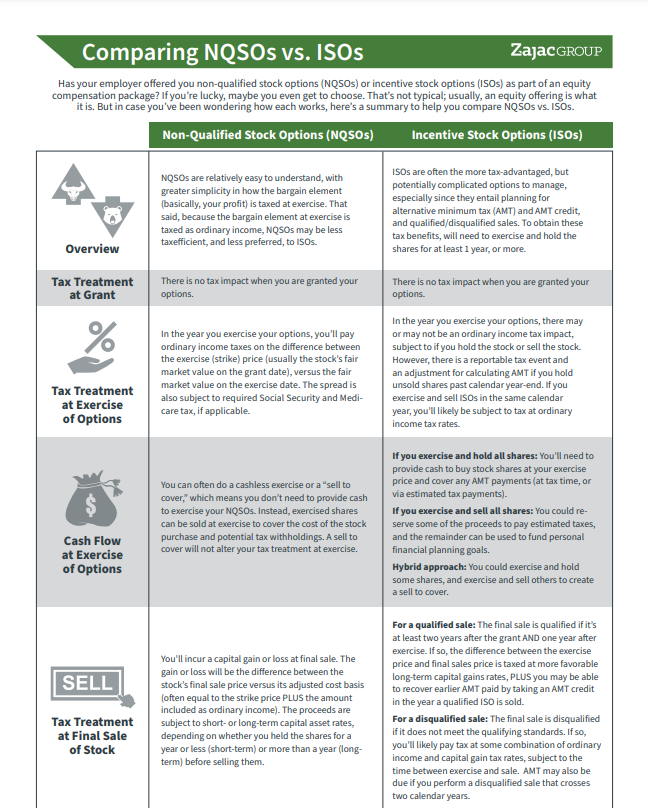

NQSOs vs. ISOs

This summary will break down the differences in how they work and what you should consider.

Mathematically equivalent on day 1, in theory, does not mean mathematically equivalent when it matters to you. Choosing RSUs or NQSOs can lead to vastly different financial results. Generally speaking, if the stock price decreases in value from the time of your grant to the time the shares vest, RSUs will have been the preferred choice as they will always have some value (assuming the price doesn’t go to zero). If the stock increases substantially from grant to vest, NQSO might be the better choice as you have more options you can exercise and more value you can capture. There is a breakeven point where the ratio of RSUs to NQSOs and the current stock price make a choice mathematically equal. This is why it’s important to illustrate how the value of your grant will change if the underlying stock goes up, down, or stays flat.

Unfortunately, no one knows which direction the stock price will go. However, what we do know is how you feel about risk, your other financial assets, and your personal goals and objectives. And we can use this information to help make a good decision.

All RSU, All NQSO, or a Combination of the Two

Fortunately, the decision of receiving RSUs vs. NQSOs is not always an all-or-nothing decision. Some companies give you a choice of how your equity compensation is awarded, and how it’s to be allocated? For example, can you receive 100% RSUs and 0% NQSOs, 50%/50%, or 0% RSUs and 100% NQSOs, or some other allocation? Take the time to consider your options to know which ones are available.

Accepting the offer of 100% RSUs will be considered the most conservative strategy as it provides the highest likelihood that you will have something of value when the shares vest. Accepting 100% NQSO is the most aggressive, as there is no value when granted, and the stock price will need to increase to have something you can cash in. A 50%/50% split might be attractive to someone who wants some security and some risk.

A Primer on the Tax Impact of NQSOs and RSUs

Non-qualified stock options and restricted stock units are taxed similarly. Both are subject to ordinary income, Social Security, and Medicare taxes. The difference, however, is when that tax is due and on what amount.

For RSUs, the tax is due when the units vest and stock shares are delivered to you. This event is pursuant to a time-based vesting schedule, over which you have no control. When units vest, the total value is taxed at ordinary income rates, with a withholding obligation by the company at a supplemental tax rate of 22% (or 37% if over $1,000,000 of income). The company typically satisfies this obligation by holding back shares that would otherwise be issued, thus resulting in the receipt of net shares.

For NQSOs, tax is due when you exercise your option. When exercised, the spread between the stock’s current fair market value and the option’s strike price is taxed as ordinary income (same rates as RSUs). Tax is often withheld at exercise in the form of a share withholding (or sell-to-cover) at a 22% supplemental tax rate (37% if over $1,000,000 of income).

For RSUs and NQSOs, if you later sell the shares at a profit, any gain above the FMV at exercise for NQSOs or above the FMV at vest for RSUs will be long or short-term capital gains, depending on how long the shares have been held since exercise or vest.

Consider the Non-Qualified Stock Option’s Strike Price

If you are choosing NQSOs, you’ll need to be aware of the strike price or exercise price of the option. This is the price that you will pay to acquire the shares of stock upon exercise. With that in mind, you should prepare for that cost. If you are offered 10,000 shares at $1 per share, the total cost would be $10,000 and mayb e manageable. However, if the strike price is $50 per share, the total cost to exercise would be $500,000 and not so easy to fund.

While there may be alternate exercise methods such as a cashless exercise, it’s essential to know that this might be an issue in the future, and planning for the proper funding of an exercise can prevent cash flow issues and unpleasant tax implications in the future.

Knowing the strike price will also be important to determine if your NQSOs are worth anything. If the strike price is $50 per share, the fair market value of the stock will need to be higher than this to make the NQSOs worth exercising. The strike price also impacts leverage, and how much you can earn based on a changing stock price.

Is the Company Public or Private?

Both public and pre-IPO companies offer equity compensation, but there is a crucial difference between the two. Pre-IPO companies typically have restrictions on liquidity which may prevent you from selling your shares and enjoying the financial benefits when you want. In contrast, public companies have a ready-made market that enables you to sell your shares when you choose (assuming you are not subject to a lockup or blackout period).

If your company is pre-IPO, you might want to consider whether you are getting RSUs or Restricted Stock Awards (RSAs) or NQSOs or incentive stock options (ISOs). RSUs vest over a certain period, and you pay taxes on the vesting date. It’s important to remember that RSUs generally do not offer voting rights, whereas RSAs do. RSAs are purchased at a nominal value, often heavily discounted, and give dividend rights before vesting; however, you cannot defer the taxes. With RSAs, but not with RSUs, you may be able to enjoy extra tax savings through an 83b election and choose to be taxed on the value at grant as opposed to upon vesting. Although you can save money by preemptively paying the taxes at a lower value, you may also be buying something that might never go public, and you may never be able to cash in on any potential value.

Review Your Current Concentration Risk

Concentration risk is financial speak for owning a single stock that makes up a material part of your net worth. Acquiring a considerable number of company shares can be a powerful way to build wealth, especially if they perform well or if your company goes public. However, too much of a single stock can leave you exposed should the market suffer a significant decline.

When choosing between RSUs and NQSOs, you should consider personal concentration risk and plan for how much you should have allocated in your company’s stock.

If you have a high-risk tolerance, are comfortable with a concentrated position, or are otherwise optimistic about the company, the riskier NQSOs might make more sense for your financial situation, especially if you are well-diversified and have other assets that can shield you if your company’s stock plummets.

However, if you already own significant equity positions in the form of incentive stock options, non-qualified stock options, or other material stock in the company, and/or have a low-risk tolerance, RSUs might be the preferred strategy.

What Are Your Other Financial Goals and Objectives

You should also determine how RSUs and NQSOs fit into your overall financial plan and have a strategy for what you will do when RSUs vest and when NQSOs should be exercised.

Financial goals are important outside of your equity compensation, so you must evaluate your current situation and see how RSUs and NQSOs fit into your overall plan. If you are looking to cash out, fund other goals, and make fewer decisions, RSU might be the best choice since you do not need to manage them as much as their option counterparts. Many of the decisions and the timing are automated through the RSU vesting process. This creates a systematic approach that allows units to vest and deal with the tax situation. However, this does not mean that no decisions need to be made or that you don’t need to pay attention.

On the flip side, if you are comfortable with a more speculative approach you may find that the options are a better fit in your overall financial roadmap. Generating wealth through the options requires an election to exercise options based on an increasing stock price, and you are hopeful that you will “win” as the share price appreciates.

Understand Your Investment Risk Tolerance

We briefly touched on risk tolerance when we discussed other portfolio holdings, but it’s such a crucial topic that we decided it deserves its own section. Investment risk tolerance ranges from conservative to aggressive in most discussions. Conservative investors focus on minimizing volatility in their portfolios and keeping their balance from fluctuating considerably over time. On the other hand, aggressive investors tend to be more comfortable with volatility because of the potentially larger upside.

Many factors influence risk tolerance, including the stage of life, financial stability, and capital commitments. Younger professionals are typically more risk-tolerant because they have many years for their portfolio to grow and recover from steep downturns. In contrast, professionals with families who are closer to retirement may be more risk-averse so that an economic downturn does not inhibit their ability to cover their expenses or stay on track for meeting their goals.

RSUs and options offer excellent solutions for both types of investors. Riskier and more aggressive investors may prefer to take more stock options since they have a much higher potential payout, but they are not guaranteed to become valuable. RSUs can be a better choice for conservative investors because they have value immediately upon vesting.

A Hypothetical Example of RSUs vs. NQSOs

Let’s take a look at a hypothetical example comparing RSUs to NQSOs, using the following assumptions.

- The ratio of NQSOs to RSUs is 3-1.

- The amount of RSUs offered is 1,000

- The current FMV of the stock price is $50 per share

- The exercise price of the NQSOs will be $50 per share

- You can take 100% RSUs, 100% NQSOs, or 50% RSUs and 50% NQSOs

To determine what may be best financially, it’s important to illustrate what could happen to the value of your grant if the stock price increases or decreases from $50 per share and compare the outcomes.

| 100% Restricted Stock Units | 50% RSU / 50% NQSO | 100% Non-Qualified Stock Options | |

| RSU Offered | 1,000 | 500 | |

| NQSO Offered | 1,500 | 3,000 | |

| Stock Price | Hypothetical FMV | Hypothetical FMV | Hypothetical FMV |

| $ 10.00 | $ 10,000.00 | $ 5,000.00 | $ – |

| $ 30.00 | $ 30,000.00 | $ 15,000.00 | $ – |

| $ 50.00 | $ 50,000.00 | $ 25,000.00 | $ – |

| $ 70.00 | $ 70,000.00 | $ 65,000.00 | $ 60,000.00 |

| $ 90.00 | $ 90,000.00 | $ 105,000.00 | $ 120,000.00 |

| $ 110.00 | $ 110,000.00 | $ 145,000.00 | $ 180,000.00 |

| $ 130.00 | $ 130,000.00 | $ 185,000.00 | $ 240,000.00 |

| $ 150.00 | $ 150,000.00 | $ 225,000.00 | $ 300,000.00 |

| $ 200.00 | $ 200,000.00 | $ 325,000.00 | $ 450,000.00 |

This is a hypothetical example and is for illustrative purposes only. No specific investments were used in this example. Actual results will vary. Past performance does not guarantee future results.

Here are a few observations we can gather from our hypothetical example.

- If the stock price stays at $50 per share, accepting 100%, RSU is the best option.

- As the stock price goes below the current FMV or $50 per share and the NQSO strike price – it is better to have more RSUs, as the NQSOs are “underwater” and have no intrinsic value.

- In this example, RSU is better at $70 but not better at $90 (breakeven is $75) between all three options.

- More than $75, NQSO is better (or a 50% increase in stock price), and it becomes significantly more advantageous as the price continues to increase.

As you can see, the company’s stock performance has a significant impact on the equity compensation’s value. If you are bullish on your company’s future, NSQOs will ultimately have a larger payout, but if you think your company has plateaued, then you may be better off with the more stable RSUs.

Tying Everything Together

On the surface, RSUs and NSQOs seem like similar equity compensation awards, especially since they are valued similarly from the company’s standpoint. However, each financial situation is unique, and you need to decide based on your own needs and financial goals. By understanding the difference between company stock and options offerings, you’ll be prepared to make tax-savvy, long-term choices.

This material is intended for informational/educational purposes only and should not be construed as investment, tax, or legal advice, a solicitation, or a recommendation to buy or sell any security or investment product. The information contained herein is taken from sources believed to be reliable, however accuracy or completeness cannot be guaranteed. Please contact your financial, tax, and legal professionals for more information specific to your situation. Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than their original value. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions.

0 Comments