Restricted Stock Units are Taxed When they are Vested and Delivered

RSUs are a powerful equity compensation tool because as long as the value is of the stock price is above zero and as long as you meet the vesting requirements, they have value to the recipient. Other equity compensation products like incentive and nonqualified stock options don’t offer similar certainty and carry additional risks for employees to realize their value.

A taxable event occurs when your RSUs vest and are delivered to you. The amount taxable is equal to the stock’s fair market value multiplied by the number of units vested. This value is considered compensation income and subject to ordinary income, Medicare, and Social Security taxes.

Thankfully, many employers make paying your RSU taxes easy by offering automated share withholding. Automatic share withholding means your employer will withhold a predetermined amount of units to cover some or all of your taxes owed. Companies often withhold the statutory rate of 22% (37% if more than 1mm of statutory income) for federal tax, plus Medicare, Social Security, and state tax if applicable. Using a hypothetical example to illustrate tax withholding upon delivery of RSUs, let’s assume the following:

- RSU Vested: 2,500

- Fair market value at vest: $50

- Total Value Taxed as Compensation Income: $125,000

- Total Tax Due: $37,063

-

- Federal (22%)

- Medicare (1.45%)

- Social Security (6.2%)

-

To cover the tax cost, 742 units will need to be withheld ($37,063/50, rounded up). This means that you’ll receive a net of 1,758 shares, for a total current value of $87,900. It’s important to remember that the statutory withholding rate may or may not be enough to cover the entire tax bill. Depending on your tax situation, you may still owe additional tax due to additional income generated from the vested RSUs. Of the many reasons to partner with a financial planner or tax professional, ensuring you know if you’ve covered your tax liability is imperative when your RSUs vest.

Keep Restricted Stock Unit Shares or Sell Them?

Once the units vest, taxes are paid, and the remainder is deposited into your account, you will need to decide whether to keep them, sell them, or a combination of the two.

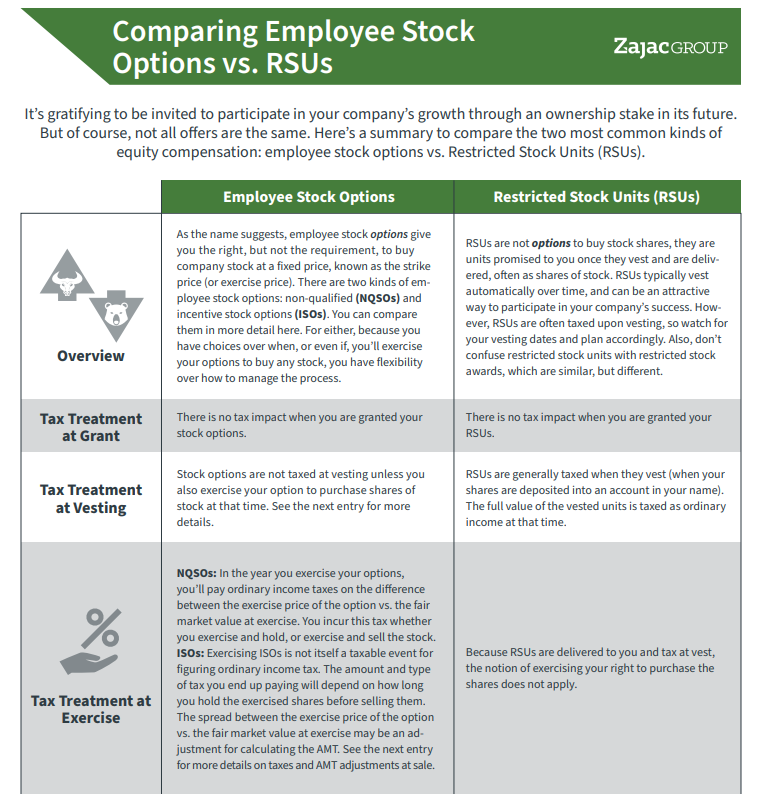

COMPARISON GUIDE

Not All Stock Offers are the Same! Here's a helpful comparison between two of the most common employee stock options.

Selling Vested Restricted Stock Units Immediately

Vested RSUs look very similar to a cash bonus in terms of taxation. However, the only difference is that a cash bonus is just that, cash. Whereas RSUs are delivered to you as shares of stock. If you wouldn’t use your cash bonus to buy shares of company stock, it may make sense that you should not keep shares of stock delivered to you from vested RSUs. In fact, by selling the shares automatically at vest, you turn the stock back into cash, making it look and feel much more like a cash bonus.

If you buy into this thought, a simple solution might be to sell all the stock right away, diverting the proceeds to cover any tax due, and using it for other savings/investment strategies and other personal financial planning goals. If you are unsure about selling all right away, you may want to sell your vested RSUs is if you have meaningful other stock in the form of ISOs, NQSO, or future vested RSUs. Selling your shares could be a tax-efficient way to diversify your company stock holdings.

Keeping Shares

Vested and delivered shares become your property, and they are no longer a future promise from your employer. As a shareholder, you now have exposure to your company’s financial performance and the opportunity to increase your portfolio’s value through your company’s stock. If you want to remain invested in your company through your RSUs, there are a few questions you need to address:

- How much of my net worth do I want to be tied to my company’s performance?

- Do my RSUs cause an imbalance in my portfolio?

- Am I still on track to meet my financial goals if I keep the shares?

- What other equity do I have through incentive stock options, nonqualified stock, or other equity compensation?

Once you work through these questions, the answers will better equip you to decide if you should keep the shares. Suppose you are comfortable with the additional risk of a heavier weighting of your company stock in the portfolio. In that case, you may not need to take further action from when the shares are deposited into your account.

Tax Planning for Stock Shares that Originated from Vested Restricted Stock Units

If you decide to sell, the first thing you’ll want to do is review your tax planning. Because depending on your tax situation created by selling shares, you may want to set aside some of the proceeds if you anticipate a higher tax bill. If you sell vested RSUs immediately, the tax impact from the sale will likely be minimal as the cost basis of the shares—the FMV on the date of vest which is recognized as compensation income – will be equal to or close to the sale price of the shares.

If you hold previously vested RSUs or are considering holding shares into the future, the tax impact of a sale is based on the gain/loss from your cost basis of the vested RSU. For example, if your shares are vested when the FMV was at $50, that would be your cost basis. If you sell your shares immediately, then you have a small or non-existent capital gains tax in addition to the income tax paid on your cost basis. If you decide to wait and sell your shares, you will have to pay capital gains tax on any appreciation above and beyond the cost basis.

Let’s say your shares vest at $50, and you want to wait until your company issues its subsequent quarterly earnings to sell them. Your company posts a robust quarterly report, and your shares jump to $61. You are satisfied with their performance, and you decide to sell. You will owe short-term capital gains tax on the $11 per share profit since you held the vested shares less than one year from the date of vesting.

Using Restricted Stock Units to Fund a Goal

Vested restricted stock units present a fantastic opportunity for you and your family to fund a significant financial goal that you may have deferred or you had already begun saving for. In fact, restricted stock units can be used to fund big projects such as a new home or smaller ones like paying off debt like a car or credit card. To fund goals successfully, however, it’s essential to know when RSUs vest, the tax impact, and how you can actively and intentionally allocate the proceeds most efficiently for your financial needs.

Accomplishing Goals Takes Time

Once you decide to use your RSU proceeds to fund a new goal, you should prepare yourself for a structured vesting and withdrawal period. Since most RSUs vest over time, you will not have the luxury of cashing out your shares all at once. The next piece of planning for your RSU sale requires you to quantify your goal in dollars. When you arrive at that number, work backward through your vesting schedule to plan how many years’ worth of vested RSUs you will need to sell to achieve your goal.

Create a hypothetical goal

Using an example to illustrate, let’s assume that you intend to purchase a home with the proceeds from the RSUs. Specifically, we will consider the following;

- Down Payment Need – $250,000

- Hypothetical Grant – 10,000 RSU

- Vesting Schedule – 25% per year for four years

- FMV of Stock –$50

- Expected timeline of events using a flat stock price and assuming we sell shares immediately upon vesting and save into the house fund

| Year 1 | Year 2 | Year 3 | Year 4 | |

| Vested Shares | 2,500 | 2,500 | 2,500 | 2,500 |

| Value at Vest | $125,000 | $125,000 | $125,000 | $125,000 |

| Tax (32%) | $40,000 | $40,000 | $40,000 | $40,000 |

| After-tax Proceeds | $85,000 | $85,000 | $85,000 | $85,000 |

| House Fund Goal | $250,000 | $250,000 | $250,000 | $250,000 |

| House Fund Current | $85,000 | 170,000 | 255,000 | |

| Short – Extra | ($165,000) | ($80,000) | $5,000 |

In the first year, $2,500 shares vest for a value of $125,000. Assuming a flat tax rate of 32%, we can figure $40,000 is due for tax, leaving after-tax proceeds of $85,000. Assigning $85,000 to the house goal of $250,000, we can calculate the remaining “need” is $165,000. Following this trend and in this example, it would take three years of vested stock to save enough for the house. At the same time, the stock price will likely change over time, and the figures will need to be adjusted, but the logic and the analysis flow through. By working with a good planner, you can continue evolving the plan and ensuring you remain on track for your goal. Although this is a hypothetical example, it illustrates the importance of planning and accounting for additional factors such as taxes before purchasing the home.

Take Your Goals Into Account Before Selling Your RSUs

As we demonstrated in the above example, significant financial goals can take years to accomplish, and it becomes much more attainable when you take the time to make a plan. RSUs can be an effective way to pay for financial goals of all sizes. Part of your planning should account for the maximum amount of funding you need, which may be less than your total vested RSU balance:

- Smaller goals – You can use some of the funds from your RSUs to achieve smaller financial goals that may not require most of your capital. If you have credit card debt, student loans, or outstanding car payments, you may decide to sell some of your shares and close out your loans. You can remain invested by selling some of the shares while improving your personal finances.

- Medium goals – If you have the same vesting schedule we used for the home purchase, you may elect to use the funds to pay for an extravagant trip or similar experience. Once the taxes are paid, you can use the proceeds to fulfill a once-in-a-lifetime dream without putting yourself in more debt or a cash crunch.

- Big goals – Depending on your RSU balance, you may want to transfer the risk from your company stock and invest in other endeavors to either diversify your portfolio or start a business of your own. If you have solid financial standing outside of your equity compensation, this might be a fantastic opportunity to become an angel investor or begin your own entrepreneurial journey.

Work With a Financial Planner to Navigate Personal Situations

Whether you want to purchase a new home, start a business, or pay off a substantial amount of debt, vested RSUs can have a meaningful impact on your financial situation. And by being proactive about planning and structuring your share sale strategy, you will be more prepared to achieve your financial goals and make the most of your RSUs.

This material is intended for informational/educational purposes only and should not be construed as investment, tax, or legal advice, a solicitation, or a recommendation to buy or sell any security or investment product. The information contained herein is taken from sources believed to be reliable, however accuracy or completeness cannot be guaranteed. Please contact your financial, tax, and legal professionals for more information specific to your situation. Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than their original value. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions.

0 Comments